Pdf of life estate deeds in sc form free printable template

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

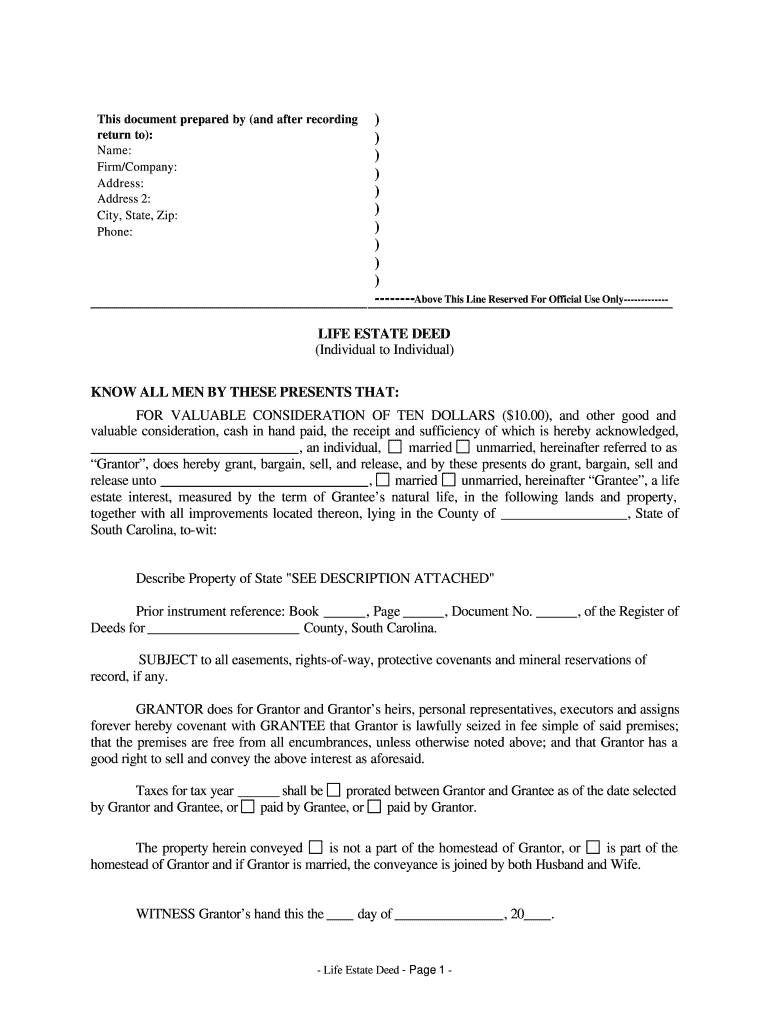

Understanding the Life Estate Form and Its Uses

What is the life estate form?

The life estate form is a legal document that allows a property owner, known as the Grantor, to transfer ownership rights to another individual, the Grantee, for the duration of the Grantee's life. This arrangement creates a life estate, meaning the Grantee can live in the property and use it without concern for future ownership until their passing. Afterward, ownership typically reverts back to the Grantor or their chosen beneficiaries.

Key features of the life estate form

The life estate form includes several critical features: it specifies the Grantor and Grantee, details the property involved, and outlines any conditions or limitations regarding the use of the property. It also includes considerations for taxes, any rights-of-way, easements, and encumbrances affecting the property. This comprehensive layout helps prevent future disputes related to ownership.

When to use the life estate form

The life estate form should be utilized in situations where an individual wishes to transfer property rights while ensuring that the Grantee has the right to live in or utilize the property for the duration of their life. Given its implications on estate planning and inheritance, it is particularly helpful for individuals wanting to manage their assets without fully relinquishing control during their lifetime.

Who needs the life estate form?

Individuals who wish to pass on real estate to a family member or trusted individual while retaining some control over the property's future often need the life estate form. This is commonly applicable for parents transferring property to children, allowing one generation to use the property while also ensuring it remains within the family.

How to fill the life estate form

Filling out the life estate form requires careful attention to detail. Begin by entering the names of both the Grantor and Grantee. Clearly describe the property being transferred, including any legal descriptions. Specify any attached conditions or stipulations, and it can be useful to include a section detailing how taxes will be handled. After completing the form, both parties should review it for accuracy and sign it in the presence of a notary to ensure legal validity.

Benefits of using the life estate form

The life estate form offers several advantages, including the ability to maintain a lifetime residency without full ownership rights being exercised until after the Grantee’s passing. It also provides a smoother transition of property upon death, potentially avoiding probate complications. Additionally, this arrangement can help preserve family wealth and ensure properties remain within the family lineage.

Common errors and troubleshooting tips

Common errors when completing the life estate form include incorrect property descriptions, failure to include necessary signatures, and not addressing how taxes will be managed. It is essential to double-check all information for accuracy and consult a legal professional if confusion arises during the filling process. Ensuring clarity in the conditions of the life estate can prevent disputes later.

Frequently Asked Questions about florida life estate deed form pdf

What is a life estate?

A life estate is a form of property ownership that lasts for the duration of a specific individual's life. Once that individual passes away, ownership typically reverts to the original owner or to other designated beneficiaries.

Is a notary required for the life estate form?

Yes, having the life estate form notarized is advisable to ensure that it is legally binding and recognized according to state laws.

pdfFiller scores top ratings on review platforms